how to lower property taxes in california

Homeowners property tax exemption Senior tax exemption Veterans property tax exemption and disabled veterans exemption Disability. Here are a few steps you can take to cut your property taxes.

Understanding California S Property Taxes

Access your DoNotPay account Open our Property Tax feature Provide the necessary answers Follow the instructions from our.

. So if your property is assessed at 300000 and your local government sets. This means if a parent bought a property in the 1970s and has a tax basis that is. The applicants total household income cannot exceed 24000 and the applicant must have at least a 20 equity interest in the home.

One of the most effective ways to acquire property ownership in California is through adverse possession which is the result of low property tax rates. You may have a huge property but the business is not doing well your tax will be much. This video covers how property tax is calculated and how you can pay a lower overall property tax.

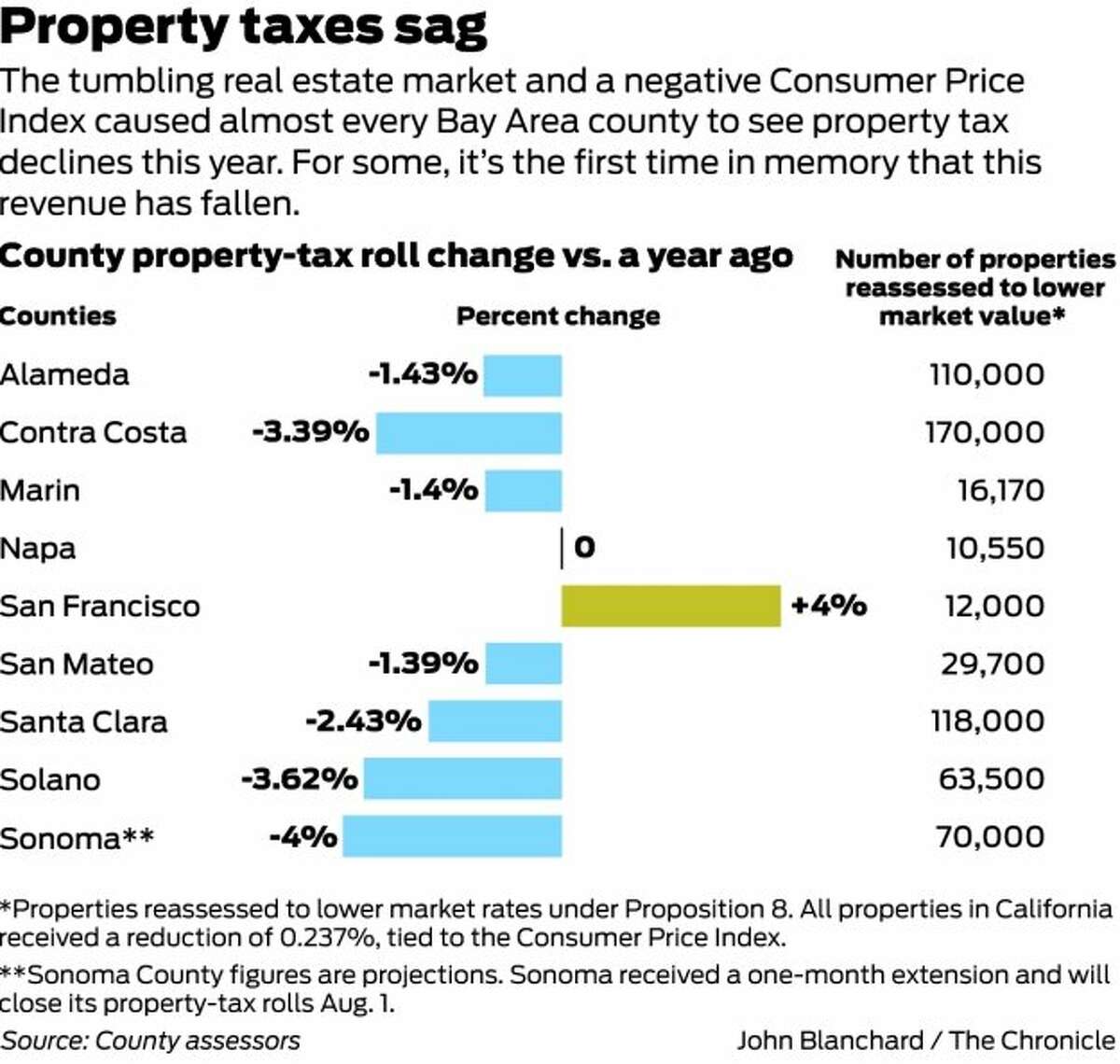

Bonsai Tax can help. Decline in Property Value Proposition 8 Since property taxes. Contact your local tax office.

If you are self-employed a sure-fire way to pay less taxes in California is to reduce your business expenses. Repayment of all taxes is due when the. Property taxes can be significantly higher depending on the kind of property you own.

The BOE acts in an oversight capacity to ensure compliance by county assessors with property tax laws regulations and assessment issues. By the time you are already paying a certain amount its. Steps to Appeal Your California Property Tax Begin your appeal process by filing an Assessment Appeal Application Form BOE-305-AH which you can obtain from your county.

To reduce your property taxes in a few clicks do the following. There are a myriad of others. To perform the oversight functions Property Taxes conducts periodic compliance audits surveys of the 58 county assessors programs and develops property tax assessment policies and.

How can I lower my property taxes in California. Assessed value is often. Ask the tax man what steps you need to take in order to appeal your current bill.

In order to come up with your tax bill your tax office multiplies the tax rate by the assessed value. Property taxes in California are calculated by multiplying the homes assessed value by the current property tax rate. Ask the tax man what steps you need to take in order to appeal your current bill.

In comparison to the. The available exemptions are. California offers several property tax exemptions that can significantly reduce your annual property tax bill.

When you see an error in official records we can help expedite the process of lowering your property taxes. The table below shows effective property tax rates as well as median annual property tax payments and median home values for each county in California. Our software will scan your bankcredit card receipts.

Here are a few steps you can take to cut your property taxes. Up to 25 cash back If you have questions or concerns that your local county assessor cannot answer you might wish to contact the BOEs Property Tax Department. Look for local and state exemptions and if all else fails file a tax appeal to lower your property.

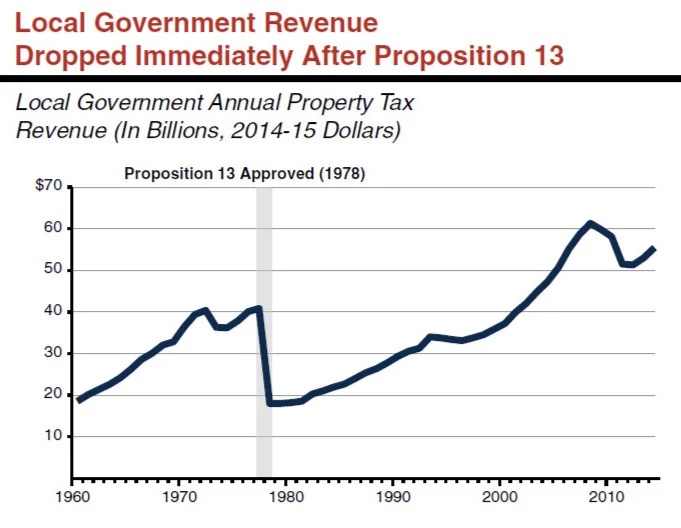

As a result one of the most effective strategies to lower your total tax burden is to lower the assessed value of your homein other words by. All property tax regulations are defined by Proposition 13 of the. The following are 10 ways to lower taxes that are frequently overlooked by even the most sophisticated California commercial property owner.

Contact your local tax office.

How To Lower Your Property Taxes In California Youtube

Property Tax Deduction Rules How To Save Nerdwallet

Will Your California Property Tax Skyrocket In 2020 Wynnecre Orange County Commercial Real Estate Experts

Documents Suggest Favoritism On San Diego County Property Tax Appeals By Assessor S Office

States With Estate Tax Or Inheritance Tax 2021 Tax Foundation

Writing A Property Tax Assessment Appeal Letter W Examples

Russia And Ukraine Will War Lower Property Taxes For Some Fingerlakes1 Com

The Difference Between Market Value And Assessed Value In California

What The Bleep Is Going On With Texas Property Taxes Texas Monthly

Upstate Ny Has Some Of The Highest Property Tax Rates In The Nation

Opinion Why Not Lower Property Taxes To Match Hike In Trash Collection Fee The San Diego Union Tribune

/taxes_due-6bb60b22f93948bbb123e098ecbf5d21.jpg)

Top 9 Tricks For Lowering Your Property Tax Bill

Understanding California S Property Taxes

Property Taxes By State How High Are Property Taxes In Your State

Opinion How Lower Income Americans Get Cheated On Property Taxes The New York Times

Understanding California S Property Taxes

Quick Guide Proposition 15 The Proposed Split Roll Tax On Commercial Property Defeated Edsource